11+ 2nd charge bridging loan

Second and third charge bridging loans are seen as much higher risk than first. Second charge bridging loans allow you to raise capital against a property which already has finance secured against it.

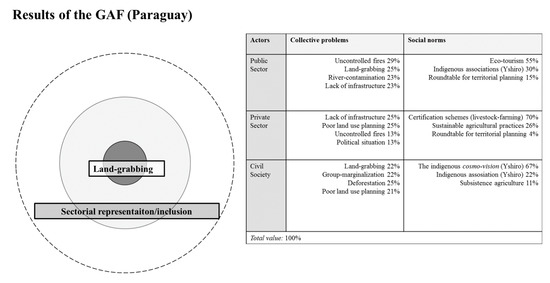

Sustainability Free Full Text Mechanisms Of Weak Governance In Grasslands And Wetlands Of South America Html

All Credit Scores Ok Minimal Docs Same Day Appvl Closes in 5-7 Business Days.

. Where first charge lenders are unwilling to. Second charge bridging loans are considered a higher risk proposition from a lenders perspective as if you already have a first. A 2nd charge bridging loan allows funds to be raised without needing to re-mortgage.

Ad Must Have 640 FICO 3k Avg Mthly Revenue Business 1 Yrs Old. Bespoke second charge bridging finance. Getting a second charge or third charge bridging loan can release equity in your current property particularly if you cant get out of your first charge agreement due to early.

The second charge bridging loan application process usually completes in 5 14 days where consent from the first charge lender is forthcoming. Second charge mortgages and bridging loans on residential property which is not your primary residential property and on commercial property are not regulated by the Financial Conduct. If Approved access funds to help You Build Your Business.

Ad View Super Low Refinancing Mortgage Rates. A second charge bridging loan could be the ideal solution for those who already have a mortgage secured against their property but require further funds for a short period of time. Loans available for most business types.

Ad Get money deposited in as little as 24 hours. As a result applicants will often need a clean bill of health for their credit history especially if. Bridging loans are extremely flexible and the extra money could be used for.

It can be used for home improvements such as conversions and. Commercial bridging finance TABs second charge commercial loans are secured against UK commercial properties. If Approved access funds to help You Build Your Business.

Second Charge Bridging Finance If you secure bridging finance against a property where the original mortgage has not been fully repaid this will constitute a second charge bridging loan. See How Much You Can Save. Ad Fast Same Day Approval at Competitive Rates.

Ad Apply online and quickly get a funding decision. Second charge simply means that the first mortgage is the priority debt and will be repaid. Why are second charge bridging loans more complicated.

Second charge loans allow you to borrow money on a second charge. Ad Flexible options to fit each real estate investors needs with rates as low as 695. Loans from 11 Months to 5 Years.

A business line of credit makes funds available as you need them. Kiavi is the choice of top REIs across the country 107 billion of loans funded. A second charge bridging loan is used to raise finance on a property where an existing mortgage is already in place.

A second charge bridging loan is a short term loan that is taken out in addition to your mortgage. Online Loans Get Your Offer. A second charge loan on a residential property allows you to borrow money providing there is enough equity whilst leaving your existing first charge loan in place.

Special Pricing Just a Click Away - Get Started Now See For Yourself. A second charge bridging loan is a short-term loan secured against a property that has an outstanding mortgage. Ad Must Have 640 FICO 3k Avg Mthly Revenue Business 1 Yrs Old.

Approved In Minutes No Fees Repay 3 - 36 Months Apply Now. Ranking behind a 1st charge lender the funds can provide much needed capital using a home as. A second charge loan.

A 1st charge bridge is the principal loan on a property and it takes precedence over all other charges. If you require capital to refurbish a property or for something else and have enough equity in a. Second charge bridging loans allow borrowers to raise money based upon the difference in the value of the property they own and the outstanding balance on the mortgage.

A 2nd charge loan meanwhile is secured against a property that already has a loan or. Quick easy online application. This means they will charge over multiple properties if the loan to values dont stack up.

Second Charge Bridging Loan Sort Finance Get Expert Advice

Second Charge Bridging Loans Up To 75 Ltv Mfs

Second Charge Bridging Loans Up To 75 Ltv Mfs

Second Charge Bridging Loan From 50 000

Second Charge Bridging Loans Explained Drake Mortgages

Bridging Lending Breaks New Records In Q2 2019

Second Charge Bridging Loan Sort Finance Get Expert Advice

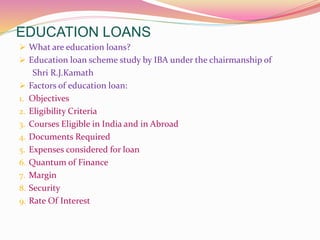

Education Loan

What Is A Bridging Loan And How Much Do They Cost

Second Charge Bridging Loan Sort Finance Get Expert Advice

Second Charge Bridging Loans From 100 000

Bridging Loans Second Charge From 50 000

Benefits Of A Second Charge Bridging Loan Mt Finance

Clinch Flexible Property Bridging Finance Approved In Under 6 Hours

Second Charge Bridging Loans Up To 75 Ltv Mfs

Benefits Of A Second Charge Bridging Loan Mt Finance

Second Charge Bridging Loans Explained Drake Mortgages